Optimizing Your Market Gains With ZERO Risk - A More Experienced and Personalized Approach

Gaining Control and Predictability In Uncertain Times

Remember!

Interest-Returns is Something You Earn and Should be Able to Keep

- Upside Gains

- NO Downside Loss of Gains Or Principal

What are the Hurdles Retirement?

- Outliving Your Money

- Need Income to Keep Up with Inflation the “Silent Killer"

- Succession Planning

- LTC Concerns (1 in 2)

CONTROL = PREDICTABILITY

where things are going= INCOME

If We Break Down All Of Our Financial Concerns Into One Word, What Would That Word Be?

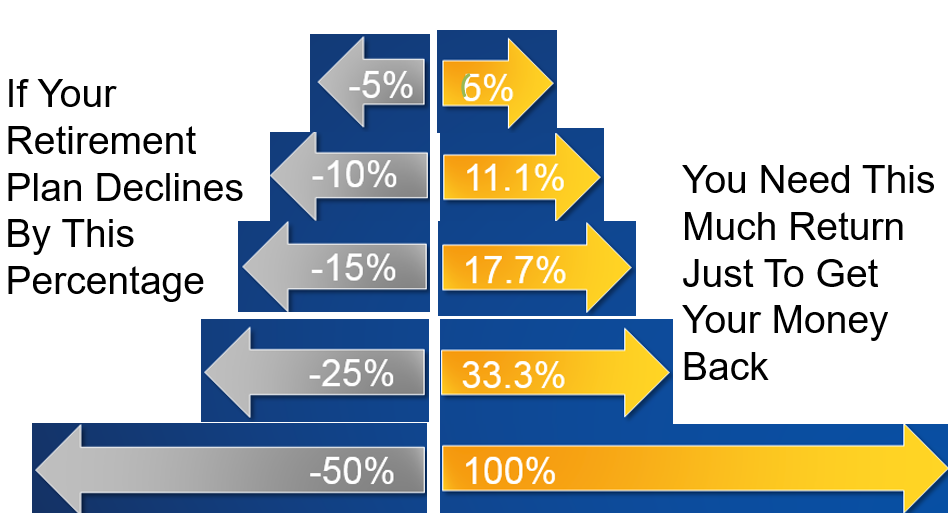

Recovering From Market Losses

What Is Your Time “Gap” to Recover Losses?

Meet Your Advisor

With over 25 years of financial expertise, I specialize in assisting Individuals, State, Federal employees and Retirees. My services encompass a broad range of retirement plans including 401(k)s, TSPs, IRAs, 457s, 403(b)s, and SEP IRAs, among all qualified plans. Additionally, I help manage non-qualified money, which refers to funds that have already been taxed. These funds are typically held in non-qualified accounts such as savings accounts, brokerage accounts, life insurance policies, or annuities. While non-qualified accounts don’t receive preferential tax treatment, some, like annuities, have tax-deferred status, meaning that earnings are deferred until they are withdrawn. Properly engineered life insurance policies can also subsidize retirement income tax-free.

With over 25 years of financial expertise, I specialize in assisting Individuals, State, Federal employees and Retirees. My services encompass a broad range of retirement plans including 401(k)s, TSPs, IRAs, 457s, 403(b)s, and SEP IRAs, among all qualified plans. Additionally, I help manage non-qualified money, which refers to funds that have already been taxed. These funds are typically held in non-qualified accounts such as savings accounts, brokerage accounts, life insurance policies, or annuities. While non-qualified accounts don’t receive preferential tax treatment, some, like annuities, have tax-deferred status, meaning that earnings are deferred until they are withdrawn. Properly engineered life insurance policies can also subsidize retirement income tax-free.

Debra Gould

Licensed Annuity Expert

Your Needs, Hopes, and Dreams

My commitment to your wealth and financial well-being is unwavering. I aim to serve my clients by providing the opportunity to live financially secure lives, full of trust and confidence, empowering them to pursue their passions.

Financial Insights for Today's and Tomorrow's Retirees

My Philosophy

Capital Protection: Establish a solid foundation to protect your capital.

Sound Financial Strategies: Develop strategies that mitigate taxes, minimize risk, and eliminate loss of gains and principal.

My Commitment

- Client's Best Interest

- Optimal Opportunities: Provide the best investment opportunities suitable solely to your situation.

- Exceptional Unbiased Service

- Tax Laws: Stay abreast of cutting-edge tax laws and leverage them to your advantage.

- Open Communication

- Education: Empower you to make informed financial decisions through education.

Through these principles and commitments, I strive to help you achieve a financially secure future, allowing you to focus on what truly matters: your passions and dreams.

Financial Pressure Affects Us All at Some Point.

Minimizing Loss, Risk and Taxes Should be a Top Priority before Retirement.

Helping You Stay Financially Healthy

Here is What You Can Expect

“Once you decide to book an appointment with me, we will begin with an initial call, followed by a scheduled live virtual introduction on Zoom. Please ensure that you provide an accurate email address and phone number, as I will use these to send you a Zoom link once we confirm the date and time of our meeting. Additionally, I typically send a reminder 24 hours before our scheduled session.

That’s it! This meeting is all about you—your opportunity to speak with an expert in the annuity industry and get all your questions answered in plain English. No sales hype. No opinions. Just verifiable facts to help you gain clarity on wealth accumulation, legacy planning, or retirement.”

Absolutely no fees for my service

"Unlike many typical financial advisors, I adhere strictly to Annuity Suitability Guidelines and standards. These guidelines ensure that any recommended annuity aligns with the client’s unique financial goals and circumstances. As part of this process, annuity insurers and agents carefully evaluate key factors such as the client’s income, age, assets, and liquidity needs before making a recommendation."

Here is What You Can Expect

01.

Tax Consultantion

Quis morbi hendrerit tellus eleifend amet nec massa. Non felis consectetur eget cras neque augue malesuada urna urna. Tellus lobortis sed elit dignissim ipsum duis.

02.

Finance Consultantion

Tempus leo consectetur nullam tristique adipiscing. Hendrerit tellus eleifend amet nec massa. Non felis consectetur eget cras neque augue malesuada.

03.

Business Consultantion

Consectetur eget cras neque augue malesuada urna urna. Hendrerit tellus eleifend amet nec massa. Non felis consectetur eget cras neque augue malesuada.

Need Help?