Optimizing Your Market Gains With ZERO Risk - A More Experienced and Personalized Approach

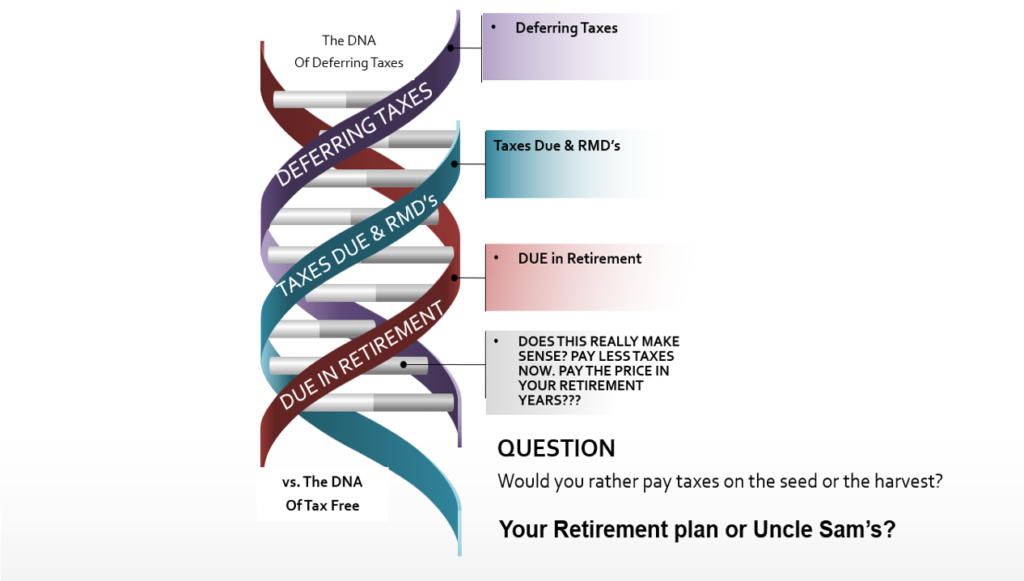

Tax Free Strategy

Free Your Retirement!

Tax-Free Withdrawals and Loans: IUL policies shine in their ability to offer tax-free access to your funds. Whether you’re making withdrawals or taking out loans against the policy’s cash value, the money you receive isn’t subject to income tax. This is a clear advantage over other retirement savings vehicles. Another feature of indexed universal life insurance is that you are never limited to what amount you can contribute, like in a 401k, IRA, or ROTH IRA.

- Tax Savings: Contributions grow tax-free, and loans and withdrawals during retirement are also tax-free, providing significant tax savings over time.

- The compounding of tax-deferred contributions and earnings leads to higher cash value growth.

- Financial Flexibility: Tax-free retirement plans often provide more flexibility regarding withdrawal options and investment choices.

- Estate Planning Benefits: These plans can be advantageous for estate planning, as they may offer tax-free inheritance options for beneficiaries.

Indexed universal life (IUL) insurance offers several tax benefits, including tax-deferred cash value growth, tax-free withdrawals, and tax-free death benefits.

Tax-deferred cash value growth

- The cash value in an IUL policy grows tax-deferred, meaning you don’t pay taxes on the gains until you withdraw the funds.

- This allows you to build wealth tax-free to fund retirement.

Tax-free withdrawals

- Withdrawals from the policy’s cash value are tax-free up to the amount of premiums paid into the policy.

- This is because these withdrawals are considered a return of the policyholder’s basis.

Tax-free death benefits

- The death benefit paid to beneficiaries is generally tax-free.

- This provides a significant financial advantage.

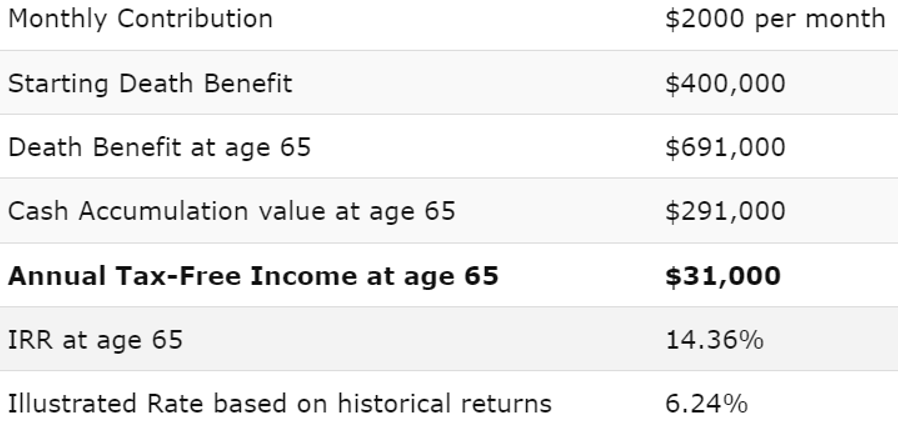

Estimations for a 55-year-old

Now Compare $291,000.00 Tax Deferred Plan-Taxes due in retirement, required minimum distributions. Assume 20% tax rate <-$58,200.00> loss to taxes or if in higher tax bracket?

How to Maximize an IUL Policy for Tax-Free Income To ensure your Indexed Universal Life (IUL) policy performs as a powerful wealth-building tool and provides the most tax-free income, it’s essential to follow these three key rules:

Properly Structure the IUL Policy

Purchase the smallest amount of life insurance possible within IRS guidelines to maximize your policy’s cash value growth. This requires precise calculations, which should be done by a qualified advisor. Our team can run these numbers to help ensure your policy is structured optimally.

Fund the Policy with the Maximum Premium

Contribute the highest possible premium without causing the policy to become a Modified Endowment Contract (MEC). Our calculation process automatically ensures your policy avoids MEC status. We typically recommend funding your policy using the guideline premium test to maximize its efficiency.

Develop a Strategic Contribution Schedule

Based on your financial goals and timeline, we’ll help you create a tailored funding schedule. This could involve:

- Short pay: Contributing all necessary funds within five years.

- Consistent contributions: Making regular payments until you’re ready to start withdrawing tax-free income.

By following these simple rules, your IUL policy can evolve into a wealth-building machine rather than just a traditional life insurance policy.

Why an IUL Can Outperform Traditional Retirement Products

An IUL policy offers several unique advantages:

- No federal contribution limits – Unlike traditional retirement accounts, you can contribute as much as you’d like.

- No penalties for early withdrawals – Access your funds when you need them without penalty.

- No required minimum distributions (RMDs) – You’re not forced to withdraw funds at a certain age.

- Tax-free income stream – Income taken as policy loans is not taxed, preserving your cash flow.

- No impact on Social Security – Since policy loans are not considered taxable income, they don’t reduce your Social Security benefits.

Indices that Your IUL Can be Linked To

The IUL is set up to allow the policyholder to invest a periodic premium into the policy. A portion goes toward the cost of life insurance. The balance is deposited in a cash account that earns interest based on the index selected.

Although the options available depend on the insurer and the product, the more traditional index options available are:

- The S&P 500

- The Dow Jones Industrial Average

- The NASDAQ 100

- The Russell 2000 Index

It’s important to note that the cash in your IUL cash value is not directly invested in these various indices; rather, the account is linked to the performance of the indices you choose to link to.

You Are in Control of Your Tax-Free Retirement Plan

Indexed Universal Life (IUL) insurance empowers you to stay in control of your financial future. While it is primarily life insurance, it shares some characteristics of an investment product, offering unparalleled flexibility and tax advantages.

With an IUL, you can access your cash at any time, for any reason, without the tax consequences that accompany most traditional investment products.

The Advantages of IUL Flexibility

- Unlimited Contributions: There is no cap on the amount you can contribute, as long as the policy is set up correctly from the beginning.

- Adjustable Payments: Need to pause premium payments temporarily? With an IUL, you can suspend payments as needed.

- Customizable Options: You can modify your death benefit, premium amount, and payment frequency, giving you greater control over your financial plan.

This level of flexibility is ideal for individuals looking to complement their retirement savings with a tax-advantaged solution.

A Perfect Option for High-Income Earners

An IUL can be especially beneficial for healthy, high-income earners who have already maxed out contributions to their 401(k), IRA, or SEP accounts. For those frustrated by the limitations, heavy regulations, and high risks associated with traditional investment products, an IUL offers a compelling alternative.

Converting Retirement Savings for Tax Efficiency

The IRS doesn’t allow direct rollovers of existing retirement plans (such as IRAs or 401(k)s) into an IUL policy. However, many individuals today are:

- Converting portions of IRAs and 401(k)s to Roth IRAs or IUL policies.

- Exploring Roth IRA conversions or IRA-to-IUL conversions as a strategy to save thousands in taxes while securing tax-free income for retirement.

The Bottom Line Indexed Universal Life insurance provides high earners with a flexible, tax-advantaged solution for retirement planning. Whether you’re looking to supplement existing accounts or diversify your financial portfolio, an IUL offers control, growth potential, and protection from market risks—all while enabling you to enjoy a tax-free income stream in retirement.

Loans and Withdrawals: Unlocking the Flexibility of Your Policy

One of the most powerful features of an Indexed Universal Life (IUL) policy is the ability to access your funds through loans or withdrawals, providing you with flexibility while maintaining tax advantages.

- Loans Are Tax-Free:

Loans against your policy are entirely tax-free. Additionally, there is no obligation to repay these loans during your lifetime. The borrowed amount, along with any interest, is simply deducted from the death benefit when the policyholder passes away. - Withdrawals Are Tax-Advantaged:

Withdrawals from your policy are tax-free up to the basis (the total amount of premiums you’ve paid). This ensures you can access a portion of your cash value without triggering tax liabilities.

Why This Matters

These features make an IUL an excellent tool for creating liquidity during your lifetime while preserving long-term benefits for your beneficiaries. Whether you’re looking to fund a major purchase, supplement retirement income, or address unexpected expenses, the flexibility of loans and withdrawals ensures your financial goals remain within reach.

Indexed Account Mechanics Indexed Universal Life Insurance

How the Insurance Company Allocates and Invests Your Premium

When you purchase an Indexed Universal Life (IUL) policy, the insurance company invests the premium you pay to generate returns. For simplicity, this example focuses on how the first premium paid at the issue of an IUL policy is handled, assuming the policyowner has selected an annual point-to-point crediting method with a cap rate based on a stock market index. Let’s examine what happens to a $10,000 premium:

Step 1

Fixed Investments for Floor Rate Guarantee

- The insurance company allocates approximately $9,500 of the $10,000 premium into fixed investments such as high-grade corporate bonds.

- These bonds, part of the insurance company’s general account, yield a return of approximately 5% annually, ensuring this portion grows back to the original $10,000 within one year.

- This growth guarantees the policy’s floor rate, protecting against potential losses if the stock market index performs poorly.

Step 2

Purchasing a “Bull Call Spread”

The remaining $500 of the premium is used to buy a financial instrument known as a bull call spread, which consists of two parts:

Buying an In-The-Money Call Option:

The insurance company purchases a call option on the stock market index that is already “in-the-money.”

This call option provides gains if the stock market index rises over the one-year period.

Selling a Call Option to Offset Costs:

If the insurance company only purchased the in-the-money call option, the upside potential would be unlimited. However, this option is expensive—in this example, costing $600, which is $100 more than the $500 available.

To bridge this gap, the insurance company sells a call option to another party. The buyer of this option gains the right to participate in market gains beyond a certain cap rate, thus limiting the upside potential for the IUL policyholder.

How the Index Cap Rate is Determined

The cap rate is defined by the spread between the cost of purchasing the in-the-money call option and the proceeds from selling the second call option. This spread reflects the trade-off between guaranteed growth and capped market participation.

Key Takeaways

- The general account investments provide security and guarantee the floor rate, ensuring no losses in poor market conditions.

- The bull call spread enables participation in market gains up to the cap rate while keeping costs manageable for the insurance company.

This balanced approach allows IUL policies to offer a combination of downside protection and growth potential linked to stock market performance, making them a unique financial tool for retirement and wealth-building strategies.

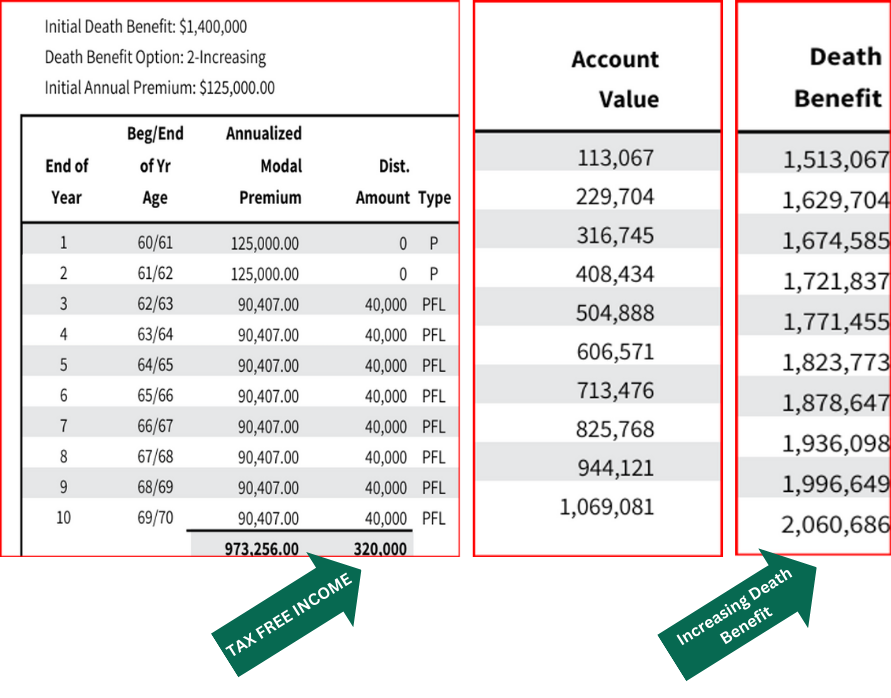

Actual Client Case Example for Educational Purposes Only Lifetime Income Tax Free

The Advantages of IUL Flexibility

- Year 10 $320,000.00 paid in annual income Plus Balance of $1,069,081 Total $1,389,081 <Minus $973,256> Equals: $415,825 10 Year Return

- Premiums Paid 10 Years $973,256.00

- Plus, Increasing Death Benefit Year 10 $2,060,686